Why Refinance with Land Title?

Refinancing your home should go as smoothly and efficiently as possible. Land Title works with your lender to achieve this through a quick and streamlined experience. Contact our Refi Group today to learn more.

Preparing For a Refinance Closing

Your lender may contact you about any outstanding requirements or conditions. Be sure to contact Land Title or your lender directly for any additional questions or concerns during this process.

Compile any loan account information available, as well as the last four digits of your Social Security Number in case this information is required. (Note: there are other areas in addition to the payoffs that may be requested from you)

In the case that courtesy payments or debts unrelated to the property are being paid out of the closing, full account information and accurate statements will be requested. Confirm that you have the most recent statements to attach to your payment check. Land Title is not liable for late fee costs incurred in such cases.

“Good Funds” are any funds over $500 due at the closing, required to be in the form of a cashier’s check payable to yourself to endorse over or to Land Title Guarantee Company. Money orders are not an acceptable form of payment or good funds.

Federal law allows you to cancel the transaction within three days of signing the documents if you are refinancing your principal residence. No money will be disbursed until this time has passed.

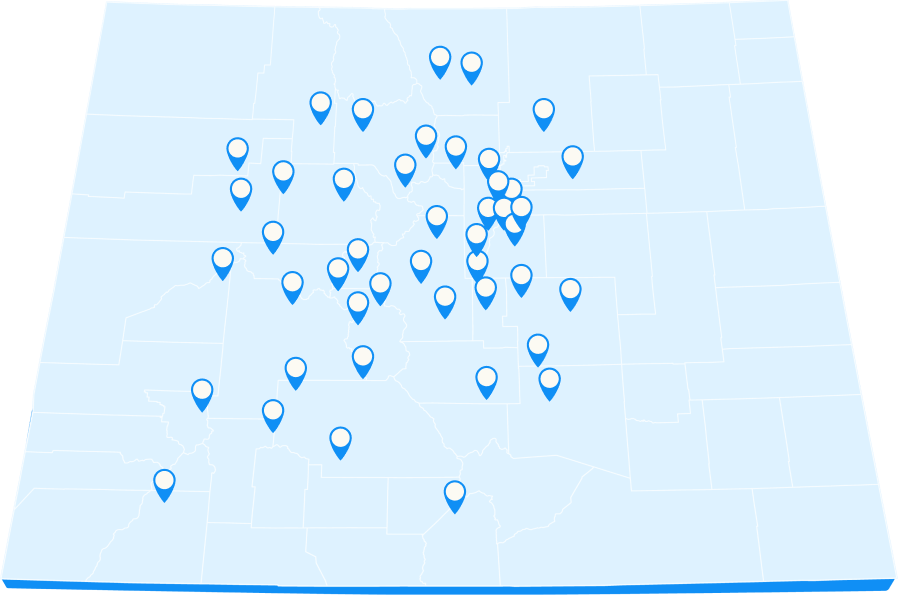

Land Title Guarantee Company is Colorado’s largest locally owned and operated title agency. We offer big company stability with a small firm’s personal service. Since 1967, Land Title customers can rely on thorough record searches and secure handling of money and information along with accurate and on-time processing of every transaction.

1967

Established

600+

Employees

50+

Offices

Sales Lead

Sana Hasan

Email me

We take email safety seriously and use this form as a way to send your communication securely. Please note that this form will be sent directly to my email.

Closing Agent

Nicole Breed

Email me

We take email safety seriously and use this form as a way to send your communication securely. Please note that this form will be sent directly to my email.

Closing Agent

Nicole Hicks

Email me

We take email safety seriously and use this form as a way to send your communication securely. Please note that this form will be sent directly to my email.

Sales

Eric Penrod

Email me

We take email safety seriously and use this form as a way to send your communication securely. Please note that this form will be sent directly to my email.

Popular Articles

Navigating a Short Sale: What to Know and What to Expect

Read the Article

Enhance Your Lead Generation Strategy with the “Likely to List”…

Read the Article

NAIOP Colorado’s 23rd Annual Rocky Mountain Real Estate Challenge…

Read the Article

Land Title’s 2024 Fall Charitable Campaign Update

Read the Article

Land Title’s 2024 Fall Charitable Campaign

Read the Article

Our Commons Office Has Moved To Suite #101!

Read the Article

Our Approach to the New Affordable Housing ROFR/ROFO Law

Read the Article

Luke Davidson Promoted to Sales Manager, Commercial Group

Read the Article

ComDocPro: Association Document Procurement

Read the Article

When Does a Title Company Typically Require a Survey or ILC?

Read the Article

Peak Innovation Park in Colorado Springs Selected for the 20th Anniversary…

Read the Article

Land Title Supports Boulder Community With Donation to Wildfire Fund

Read the Article

Land Title Supports Habitat for Humanity for Fall 2021 Charity Campaign

Read the Article

First-Time Home Buyer? A Few Things to Know

Read the Article

Questions to ask when Selecting a Title Company

Read the Article

What to Expect at Your Land Title Closing

Read the Article

What is Remote Online Notarization (RON) and How Does it Work?

Read the Article

Mental Health Awareness: We are all in this together

Read the Article

Wire Transfers & Your Real Estate Transaction

Read the Article

January 31, 2019: John E. Freyer is inducted into the Colorado Business…

Read the Article

Understanding Deed Forms & Contract Changes

Read the Article

Using Title Insurance to Mitigate Risk Created by Mechanic’s Liens

Read the Article

Prepare your Home for the Spring Selling Market

Read the Article

Types of Co-ownership in Colorado: Joint Tenancy & Tenants in Common

Read the Article

Water Law in Real Estate Transactions Part Two: Conveyance of Water Rights…

Read the Article

Water Law in Real Estate Transactions Part One: Understanding Water Rights

Read the Article

Title Requirements for Trust and Operating Agreements

Read the Article

Property Tax Assessments: How they are determined

Read the Article

Personal Representatives Duties, Responsibilities and Liabilities

Read the Article

How does the foreclosure controversy affect Colorado?

Read the Article

Condominium Parking Spaces: How they are Created, Owned, Transferred and…

Read the Article

Colorado Foreclosure Timeline Part Two: Understanding the Foreclosure Process

Read the Article

Colorado Foreclosure Timeline Part One: Understanding the Foreclosure Process

Read the Article

1099 Certification Process and Colorado 2% Withholding

Read the Article

Understanding the Owner’s Policy for Title Insurance

Read the Article